I provide a guide for beginner stock investors. Are you eager to invest in stocks but feeling a bit nervous? It’s completely normal to feel that way, especially when you’re just starting. Let’s break down some key points to help you get started on your investment journey. Wishing you all the best!

The Basics And Essence of Stocks Investing

It has been said that less than 5% of individual investors consistently outperform inflation in the long term. Is this just because of a difference in information? If you understand the basic rules of stocks, you could have made money even if you didn’t have as much information as the others.

The basics are important for everything. I recommend that you start investing after you’ve built a strong foundation in the basics of stock investing.

1) Don’t Chase After Hot Stocks

I think that a lot of individual investors have a flawed mindset. They seem to think that being a successful investor is all about picking hot stocks and making quick profits.

If you’re the kind of person who chases after quick gains in the stocks, I suggest you spend that money on a vacation with your family or a nice dinner instead. Looking for stocks that suddenly jump in price is like trying to win at a casino.

Owning a stock means owning a piece of company. The essence of investing in stocks is finding promising companies and becoming a part-owner. It’s like joining a company on its journey to success.

2) Investing In Stocks Should Be Boring

When I first started investing, I was so obsessed that I had to use three or four monitors, a tablet, and a smartphone. I’d sacrifice other tasks just to keep an eye on the market every second, but I couldn’t still outperform the market.

But these days, I only check my investments once a month. Surprisingly, I’m making more money than when I was constantly glued to the screen. I just need to make sure my stocks are still aligned with my plan, and I’m free to relax and enjoy life.

3) You Should Invest Your Spare Money

To follow the points 1 and 2, you should invest with spare money.

As I mentioned before, a company’s profits or prospects don’t improve overnight. Also instead of, chasing stocks that suddenly spike in a short period, we should patiently gather shares of companies that have the potential to do well. For this reason, our investment should start with spare money.

If you need money soon for something like a down payment on an apartment or a child’s college tuition, you’ll feel pressured. Eventually, you’ll either chase after quickly rising stocks for profit or be unable to wait for the good stocks you’ve bought to mature.

Experience shows that good companies usually bring returns within 6 months to 2~3 years. So spare money means money you won’t need for at least 3 years.

How Much Money Do I Need To Start Investing In Stocks?

1) Understanding Stock Purchases

When I first started investing, I was curious about this too. If I want to buy APPLE stock which was worth 100 dollars, do I need exactly 100 dollars or can I buy 50 dollars worth? The short answer is that you can buy stocks in whole units, or shares. So, in the example above, you would need at least 100 dollars. While you can buy fractional shares now, the fees are quite high. It’s simpler or more cost-effective to just buy whole shares.

So, the answer to how much money I need to start investing in stocks is ‘The price of one share of stock you want to buy.’

2) Starting Small, A Guide To Beginner Investing

Honestly, there is no fixed amount of money you need to start investing. The size of your capital is relative.

However, on average, people around me start with about $3,000. As they gain confidence, they might increase it to $10,000 or even tens of thousands of dollars. Interestingly it’s said that the top 0.5% of individual investors hold about 50% of the total capital of all individual investors.

Personally, I recommend starting less than $1,000 for the first 3~6 months. Get used to your brokerage app, read books, and observe market movements to get a feel for it. Once you’re more confident, increase your investment to around $3,000 to $5,000. Combine investing with learning for about 6 months to a year to gain experience. You can invest larger amounts when you feel comfortable with the market.

Of course, this is just a general guideline for the average worker and not a strict rule.

Where Should I Invest In The Stock Market?

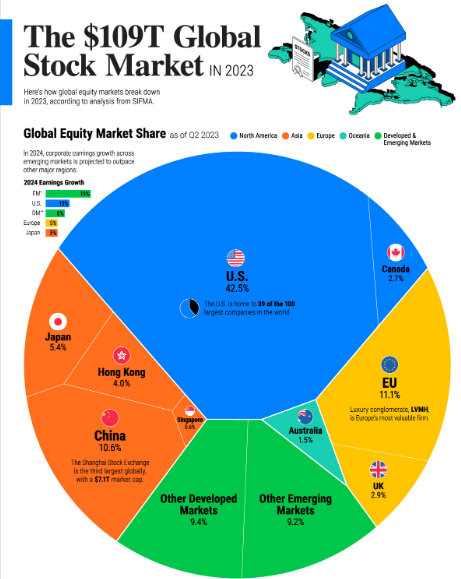

If you’re not from the US, where are you investing your money now? It’s not a good idea to only invest in your country. Money moves around the world without borders, so it’s better to look at the bigger picture.

The US stock market makes up over 40% of the global market. And a bigger market means more opportunities. That’s why it’s a good idea to have a large portion of your investments in US stock. If you’re not from the US, where are you investing your money now? It’s not a good idea to only invest in your country. Money moves around the world without borders, so it’s better to look at the bigger picture.

The US stock market makes up over 40% of the global market. And a bigger market means more opportunities. That’s why it’s a good idea to have a large portion of your investments in US stock. Even though I’m not an American, over 90% of my investments are in US stocks.

Sure, you have to think about exchange rates and financial reports in English, which can be difficult to learn. But it’s definitely a great market to grow your wealth. It’s like learning to motorcycle. It’s harder than a bicycle, but once you learn, you can go much faster.

For beginners, ETF

1) Think of ETF like this

There are schools that have 1,000 students, if you have to pick which students would be successful in the future from these 1,000. What would you do?

Would you bet on just the top student? Or maybe the top 10? Or would you try to find a diamond in the rough from the bottom 300?

Betting on the top student is risky. They might get into an accident or go through a rough patch. How about the students ranked 2~10? It would be a waste to ignore 11~100 students because they have the potential to success too.

What about the top 100 students? They can give us a pretty good result without too much risk. This is exactly the kind of problem that ETFs solve. Especially ‘Index-tracking ETF’.

2) Imagine the S&P 500 as a prestigious club for the top 500 companies in the US

It’s like very a exclusive club that is consistently changing its membership. Only the biggest and best companies can get in. If a company doesn’t perform well, it gets kicked out, and a new, more successful company is invited to join.

So, how can you invest in this elite group of companies?

Instead of buying shares of each of the 500 companies one by one, you can buy an ETF that tracks the S&P 500. Think of an ETF as a basket that holds all of these top companies. By buying an ETF, essentially buying a piece of all 500 companies.

Popular S&P 500 ETFs include SPY, VOO, and IVV. While they have different names, they all track the same index. The main difference between them is usually the fee you pay.

Stock Investment Skills

I’ve always been skeptical of people who claim to know the perfect time to buy a stock. Frankly, anyone who consistently predicts short-term market movements is likely exaggerating.

1) Leveraging Market Corrections for long-term gains

However, it is definitely a good idea to buy stocks over the long term. For instance, when a well-established company with solid fundamentals experiences a significant decline without any reason.

External factors, like interest rates, can also influence stock prices dramatically. Do you remember the 2022 interest rate hikes? Many stocks took a beating, regardless of their underlying performance. But those who believed in these companies continued to buy, and many of them are now reaping the rewards.

Below is the record of my Nasdaq trades that I posted on my Korean blog. If you use a translation app, you can see the reason why I bought stocks at those specific times.

Buy August-December 2022

Buy January 2023

In essence, opportunities in the stock market are always there. As a beginner, it might be painful to see stock prices fall, but you should actually be happy when that happens. It’s a sign that might be a good buying opportunity.

Remember, investing is a long-term game. Focus on gradually accumulating shares of quality companies when prices are attractive. Don’t get caught up in trying to time the market.

2) Buy And Sell Installment

The stock market is incredibly unpredictable. Even the most promising stocks can experience wild price swings from one day to the next. So, it’s a good idea to spread out your purchases over a few times, like 3 or 4 times.

There’s no one right way to invest. But I usually plan to hold my investments for at least 2~3 years. That’s why I divide my total investments into 3~4 parts and buy a little bit at a time, usually over 2~3 weeks.

I do the same when I sell. Unless I really need the money right away, I sell my stocks in small amounts, maybe 5 times. You know how it feels when a stock you own keeps going up? It can be hard to sell it, even if you’ve made a good profit.

So, buying and selling a little bit can help you stay calm and make better decisions.

Is stock investing still a good method in the future?

There are two main reasons why stocks might continue to be a good investment.

1) First, More And More Money Is Being Created

Money is like a tool we use to buy things. When there is more money available, it can make things more expensive, just like stocks are things we can buy. So, when money becomes less valuable, the price of stocks can go up.

Also, good companies can raise their prices for their products, which can lead to more profits and higher stock prices.

2) Second, The Gap Between Rich and Poor Is Getting Bigger

Strong companies use their money to do more research and hire smart people, and stay ahead. It’s hard for new companies to compete with them.

So, if you own these strong companies, you’re likely to keep making money. Companies exist to make money, and as long as companies exist, there will be opportunities to make money.

How To Learn About Stocks

I think this is what most people who are new to stocks wonder about. I believe I’ve studied the stock market more than anyone else. So, I am going to share two of the study methods I’ve used in the past that I still use or think were the best.

1) Reading Books About Stocks

I can say without a doubt that there’s no better way to learn about stocks than reading books about them.

The stock market has nearly endless possibilities. And as an investor, we can’t possibly consider all of them. That’s why we need rules. I think setting 3~4 rules and applying them is the only way to deal with a consistently changing market, rather than taking hundreds of classes.

Individual stocks are greatly influenced by the macroeconomy (interest rate, spread, policies, etc.). So let’s say you’ve read a book and come up with a rule like “If the company I’ve invested in is in a healthy industry and is consistently profitable, but its stock price is falling due to external factors, I would consider buying more shares as a buying opportunities.

– What books should I read?

I’ll give you a simple answer. Go to a bookstore and buy just one book on economics and one on stocks. Once you’ve read those, go back and buy another one of each. Please hold off on actual investing until you’ve read a total of 3 books for each topic.

Don’t worry about ratings or reviews. For beginners, the most important thing is to find books that explain the basics in a simple way. Most of these books will cover similar topics. Just pick the one that you think you’ll enjoy reading the most.

– What books should I avoid?

When you’re just starting out, it’s best to stay away from books that teach you technical skills, short-term investing strategies, or how to read charts.

You’re not going to stop investing after a year or two, right? To survive in a stock market for a long time, you need to learn things the right way, even if it’s slower. Don’t be fooled by flashy phrases like ‘special techniques’ or ‘guaranteed way to make money’. The reason why only a few people make money in the stock market is not many people invest with principles and rules. So, when you’re starting out, focus on books that teach you the basic principles of investing, rather than the technical stuff.

2) Read Daily Research Reports

There are many websites that offer daily research reports. At first, those terms might seem difficult. But if you read them often, you’ll get used to them and understand how the market is moving.

And please ignore the buy and sell recommendations or stock ratings. They are just personal opinions. You might think that fund managers are better at investing because it’s their job. But only 1% of fund managers beat the market over a long time.

So, just use these reports to ‘learn new terms’, ‘Understand how conclusions are reached’, and ‘get a sense of the market’. Read one each day, alternating between economics and individual stocks.

3) What To Avoid Studying

For beginners, it’s best to avoid watching random stock-related videos on YouTube.

It doesn’t mean the people who create those videos are unskilled. They have their own specific principles and methods that they’ve developed over time. When beginners watch these videos, they tend to focus only on the conclusions and ignore the process, leading to a confirmation bias.

However, once you’ve developed your own concepts and principles, watching YouTube videos can be helpful. You’ll be able to selectively choose what to accept and what to ignore. Everyone has their own thoughts and opinions, even when looking at the same information. So until you can develop your own perspective and analyze information, it’s better to focus on reading research reports and books.

Key Takeaways

- Invest for the long term and don’t chase after stocks that suddenly go up in price

- Use extra money to invest and spread out your buying and selling

- Start with the US stock ETF that follows the S&P 500

- Read books and research reports every day

- For beginners, stay away from videos about short-term investing or day trading. Instead, focus on books that teach you the basic rules and principles of investing

[ Recommended Readings ]